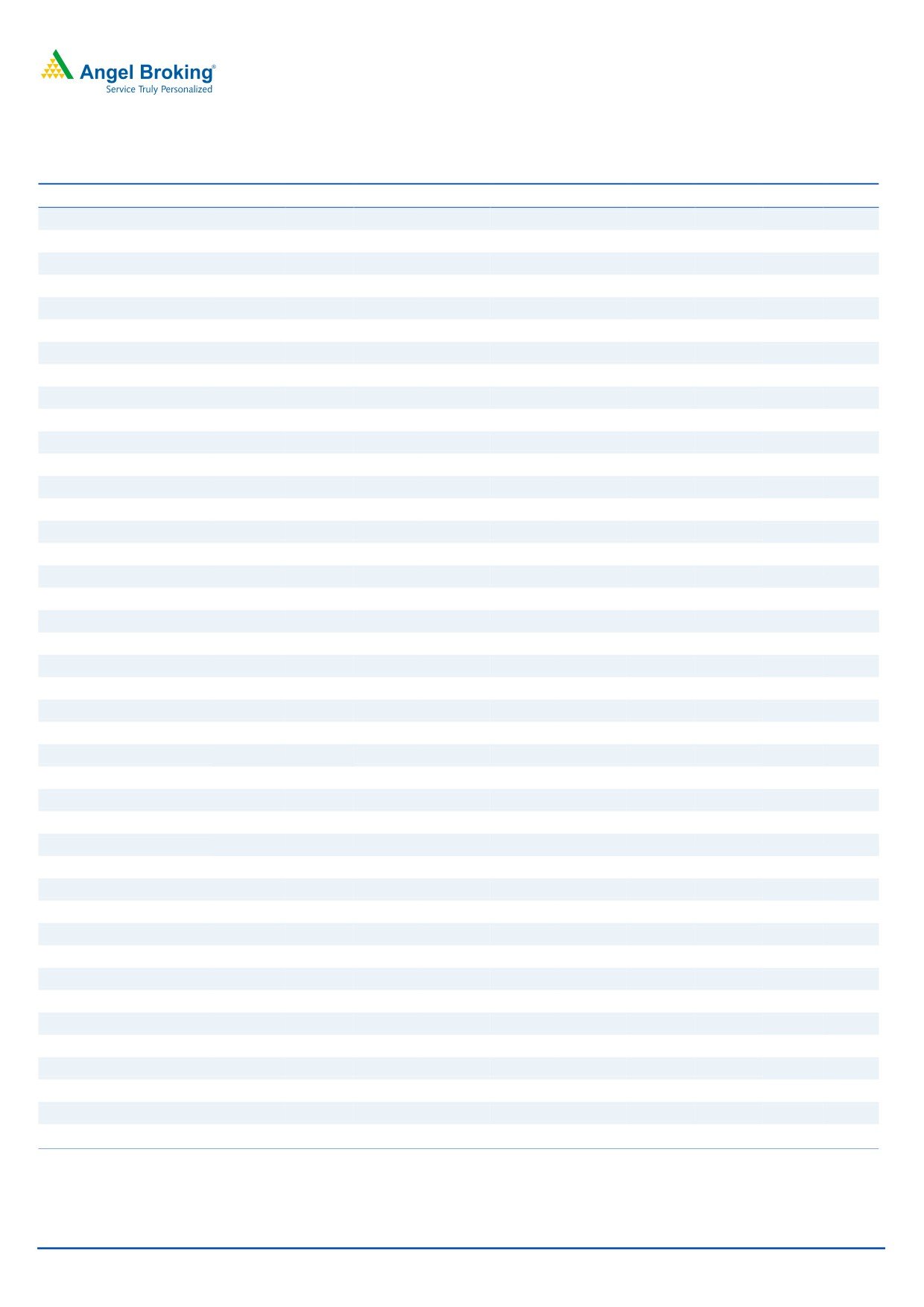

1QFY2019 Result Update | Banking

July 27, 2018

Yes Bank

BUY

CMP

`370

Performance Highlights

Target Price

`435

Particulars (` cr)

1QFY19

4QFY18

% chg (qoq)

1QFY18

% chg (yoy)

Investment Period

12 Months

NII

2,219

2,154

3.01

1,809

22.68

Sector

Banking

Pre-prov. profit

2,455

2,135

14.95

1,704

44.04

Market Cap (` cr)

32,434

PAT

1,260

1,179

6.86

966

30.54

Beta

1.6

Source: Company, Angel Research

52 Week High / Low

910/ 590

Yes bank delivered healthy set of numbers for Q1FY2019, with PAT growth of

Avg. Daily Volume

33,43,514

30.5% yoy. On the operating front, the bank reported 22.7% yoy growth in NII,

Face Value (`)

10

however, the NIM sequentially softened by 10bps driven by higher funding cost

BSE Sensex

24,825

and stable loan book yields. The bank managed to reduce its expenses and

Nifty

7,556

brought down the cost/income ratio from 42.1% in Q1FY2018 to 37.3% in

Reuters Code

YESB.BO

Q1FY2019.

Bloomberg Code

YES@IN

Robust advance growth; NIM pressurized

During 1QFY19, the bank’s advances grew by 53% yoy, of which retail loan book

Shareholding Pattern (%)

increased 105% yoy to constitute 14% of the total advances. The corporate loans

inched up by 41% yoy. The net interest income during this period grew by 22.7%

Promoters

22.0

which not commensurate to advance growth. NIM compressed by

10bps

MF / Banks / Indian Fls

23.6

sequentially owing to recent corporate lending has been in the 6-12 months MCLR

FII / NRIs / OCBs

42.0

re-pricing bucket, faster hike in deposits rates and growth in international

Indian Public / Others

12.5

business. Moreover, a slower rise in Opex aided lower cost/income by 480bps yoy

to 37.3% in Q1FY19.

Total deposits surged by 42% yoy and 6% qoq in 1QFY19. CASA deposits

accounted for 35.1% of the total deposits.

Abs. (%)

3m 1yr 3yr

On asset quality front, the bank continued to maintain strong asset quality with a

Sensex

(6.9)

(14.9)

25.5

GNPA/NPA ratio of 1.31%/0.59% of loans. Total slippages for the quarter were at

Yes Bank

1.7

(10.5)

45.3

`560cr, Management expect `320cr to be recovered/upgraded by Q2FY19.

Outlook & Valuation: We expect YES Bank to grow its advances at CAGR of 32%

over FY2018-20E. Improvement in CASA, rating up-gradation and in-house

priority sector lending would support NIM going forward. At CMP, YES trades at

2.4x FY20E P/ABV, which we believe is attractive considering growth prospects,

hence, we recommend BUY with a target price of `435 over the next 12 months.

3-year price chart

500

Key financials (Standalone)

400

Y/E March (` cr)

FY16

FY17

FY18

FY19E

FY20E

300

NII

4,567

5,797

7,737

10,593

13,967

200

100

% chg

31

27

33

37

32

0

Net profit

2,539

3,330

4,225

5,951

7,851

% chg

27

31

27

41

32

NIM (%)

3.3

3.4

3.3

3.2

3.2

Source: Company, Angel Research

EPS ( Rs)

11

14

18

26

34

P/E (x)

34

26

20

14

11

Jaikishan Parmar

P/ABV (x)

6.2

4.0

3.4

2.8

2.3

Research Analyst

RoA (%)

1.7

1.8

1.6

1.6

1.6

022 - 39357600 Ext: 6810

RoE (%)

20

19

18

21

23

Source: Company, Angel Research, Note: CMP as of 27/7/18

Please refer to important disclosures at the end of this report

1

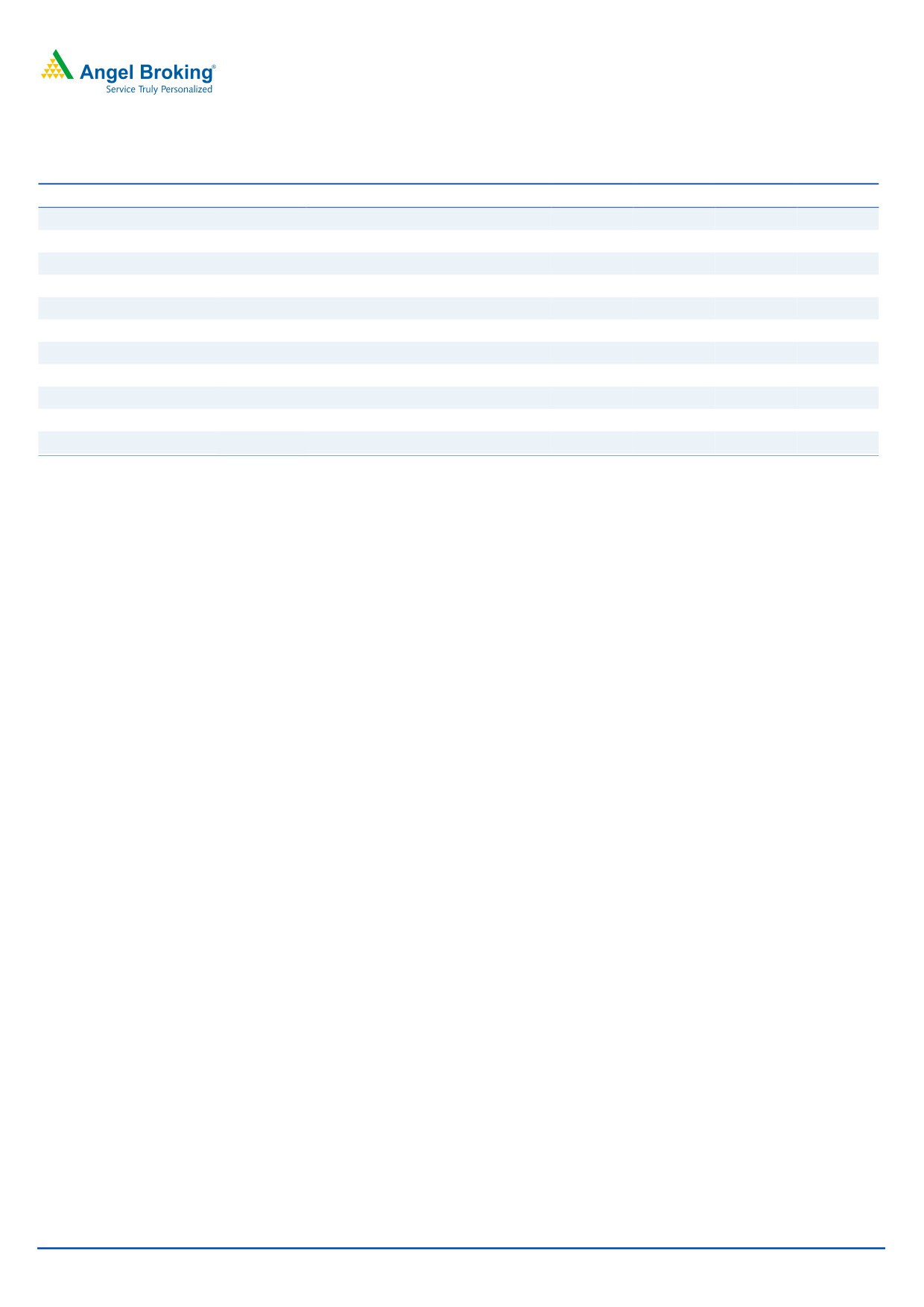

Yes Bank | Q1FY2019 Result Update

Exhibit 1: : quarterly results summary

Particulars (` cr)

Q2FY17

Q3FY17

Q4FY17

Q1FY18

Q2FY18

Q3FY18

Q4FY18

Q1FY19

% QoQ

% YoY

Interest Earned

4,060

4,213

4,349

4,654

4,800

5,070

5,743

6,578

14.5

41.3

on Advances / Bills

3,032

3,139

3,259

3,534

3,693

3,846

4,404

5,005

13.6

41.6

on investments

931

964

942

903

923

1,098

1,179

1,351

14.5

49.6

on balance with RBI

49

71

111

179

145

82

110

162

47.8

(9.7)

on others

49

39

37

37

40

44

50

60

22.1

62.4

Interest Expended

2,648

2,724

2,709

2,845

2,915

3,182

3,589

4,359

21.5

53.2

Net Interest Income

1,412

1,489

1,640

1,809

1,885

1,889

2,154

2,219

3.0

22.7

Other Income

922

1,017

1,257

1,132

1,248

1,422

1,421

1,694

19.2

49.6

Operating income

2,334

2,506

2,897

2,941

3,134

3,311

3,575

3,913

9.5

33.1

Operating Expenses

948

1,052

1,206

1,237

1,227

1,309

1,440

1,459

1.3

17.9

Employee expenses

433

467

497

546

563

533

547

591

8.0

8.2

Other Opex

515

585

709

691

664

776

893

868

(2.8)

25.6

Pre Provision Profit

1,386

1,454

1,691

1,704

1,907

2,002

2,135

2,455

15.0

44.0

Provisions & Contingencies

162

115

310

286

447

421

400

626

56.6

118.9

PBT

1,224

1,338

1,381

1,418

1,460

1,580

1,736

1,829

5.4

29.0

Provision for Taxes

423

456

467

453

457

504

556

569

2.2

25.6

Tax rate

35

34

34

32

31

32

32

31

PAT

802

883

914

966

1,003

1,077

1,179

1,260

6.9

30.5

Business Details (`)

Advance

1,10,216

1,17,087

1,32,263

1,39,972

1,48,675

1,71,515

2,03,534

2,14,720

5.5

53.4

YoY

32

35

46

54

53

Borrowing

34,589

36,921

38,607

38,302

44,830

56,302

74,894

78,790

5.2

105.7

Deposit

1,22,581

1,32,376

1,42,874

1,50,241

1,57,990

1,71,731

2,00,738

2,13,395

6.3

42.0

CA

19,192

18,773

19,966

22,604

28,826

28,333

(1.7)

50.9

SA

32,678

36,442

38,758

42,685

44,351

46,598

5.1

27.9

CASA

38,784

44,126

51,870

55,215

58,725

65,289

73,176

74,930

2.4

35.7

CASA %

32

33

36

37

37

38

36

35.1

(134)bp

(164)bp

Asset Quality

GNPA

917

1,006

2,019

1,364

2,720

2,974

2,627

2,824

7.5

107.0

NNPA

323

342

1,072

545

1,543

1,595

1,313

1,263

(3.8)

131.5

Gross NPAs (%)

1

0.85

1.52

0.97

1.82

1.72

1.28

1.31

3bp

34bp

Net NPAs (%)

0

0.29

0.81

0.39

1.04

0.93

0.64

0.59

(5)bp

20bp

PCR (Calculated, %)

65

66

47

60

43

46

50

55

527bp (473)bp

Credit Cost (Annualised) Adv

1

0.39

0.94

0.82

1.20

0.98

0.79

1.17

38bp

35bp

Profitability ratios (%)

C/I

41

42

42

42.1

39

40

40

37.3

(300)bp

(478)bp

RoE

21

22

19

17

18

18

19

19

61bp

198bp

Yield on Advance

11

10.7

9.9

10.1

9.9

9.0

8.7

9.3

67bp

(78)bp

Cost of Fund

7

6.7

6.2

6.2

6.0

5.9

5.7

6.1

44bp

(1)bp

Spread

4

4.0

3.7

3.9

4.0

3.1

3.0

3.2

23bp

(77)bp

NIM Reported

3

3.5

3.6

3.7

3.7

3.5

3.4

3.3

(10)bp

(40)bp

July 27, 2018

2

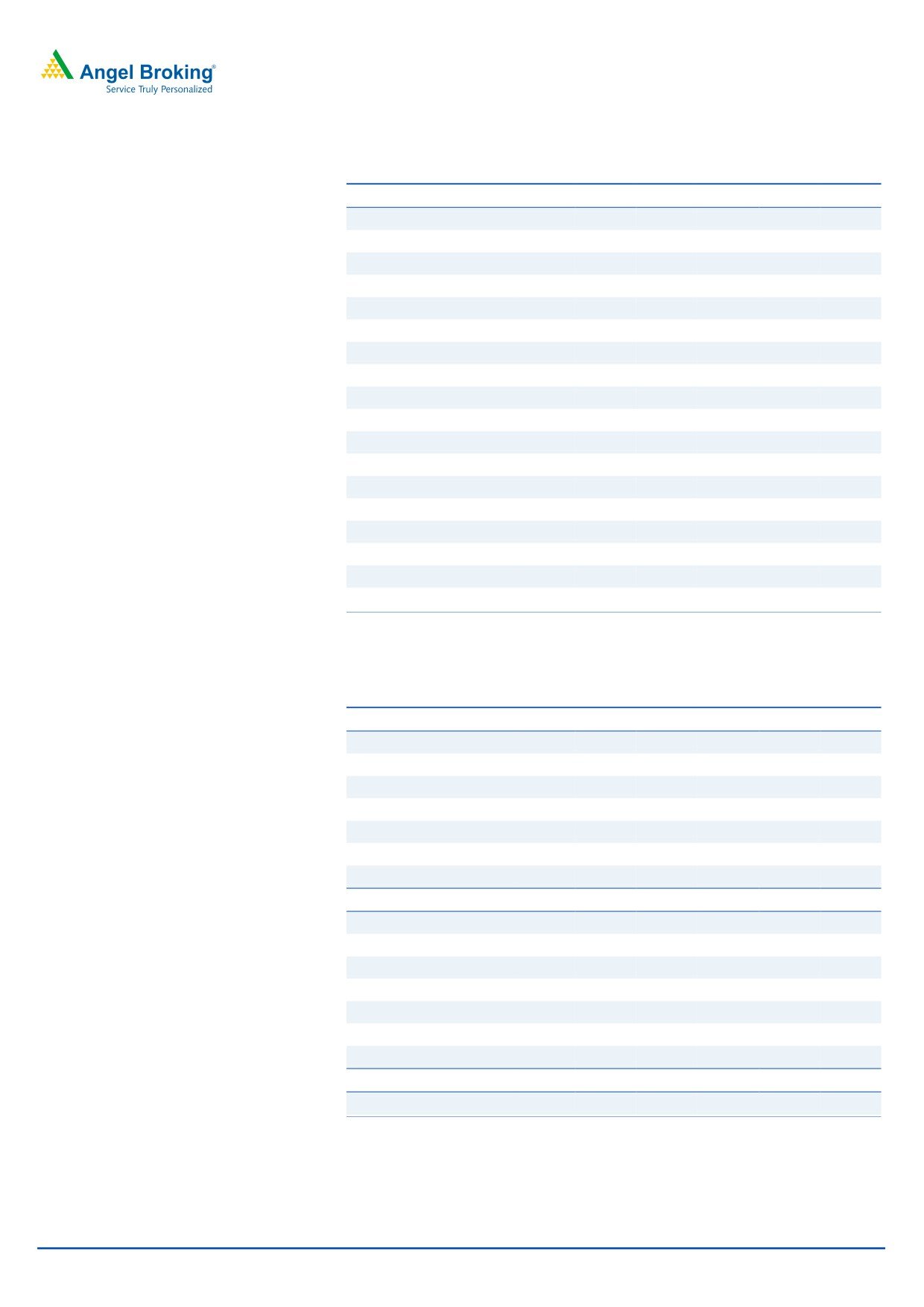

Yes Bank | Q1FY2019 Result Update

Exhibit 2: Asset Quality

Particulars (` cr)

Q2FY17

Q3FY17

Q4FY17

Q1FY18

Q2FY18

Q3FY18

Q4FY18

Q1FY19

Gross NPA

917

1,006

2,019

1,364

2,720

2,974

2,627

2,824

Net NPA

323

342

1,072

545

1,543

1,595

1,313

1,263

Gross NPA %

1

0.85

1.52

0.97

1.82

1.72

1.28

1.31

Net NPA %

0

0.29

0.81

0.39

1.04

0.93

0.64

0.59

Provision Coverage%

65

65.95

46.88

60.03

43.27

46.37

50.02

55.30

Restructured Advances %

0

0.42

0.36

0.24

0.08

0.05

0.04

0.00

Security Receipt (Net) %

0

0.22

0.73

0.69

0.94

1.06

0.92

0.82

Standard SDR %

0

0.17

0.24

0.20

0.32

0.21

-

-

5:25 Refinancing %

0

0.09

0.09

0.10

0.15

0.06

0.05

0.05

S4A %

-

0.01

0.01

0.01

0.01

0.09

0.07

0.07

Total Stressed asset

1.20

2.24

1.63

2.54

2.40

1.72

1.53

Source: Company, Angel Research

Asset quality stable; PCR improves:

Absolute GNPA increased 7.5% to `2,824cr, while NPA declined by 3.8% to

`1,263cr with provision coverage up by 530bps to 55.3%. Management has plans

to raise PCR to 60% in next 2 quarters. Total net stressed loans (NNPA, OSRL, SDR,

S4A, SR, 5:25) stood at 1.53%, down from 1.72% in Q4FY2018.

On the NCLT front, the bank recovered `184cr from one account classified under

NCLT-1. The bank's total exposure to the NCLT list 1 & 2 is `673cr. Bank's

exposure in NCLT list 1 is worth of `23cr, which is classified as NPA with 50% PCR.

Whereas exposure to the NCLT 2 is `650cr, of which `570cr is funded exposure

and has PCR of 43%.

Conference call highlights

Benefit of re-pricing of loan to accrue in subsequent quarters and recent

corporate (Q1& Q2 FY2018) lending has been in the 6-12 months MCLR re-

pricing bucket.

Forex, debt capital market and securities fee income: `70cr on account of SR

redemption, `100cr gain owing to portfolio shuffle and balance was largely

from forex and derivatives.

Corporate fees largely pertain to loan related fees.

W/o for the quarter were `131cr.

Corporate loan: 30-40% growth from working capital loans and 60-70%

growth from term loans.

Majority of the loan book is on MCLR.

Traction in MSME loan to pick up in H2FY2019.

Average SA of `1.6-1.7lakh.

C/I ratio expected to be 39-40%.

July 27, 2018

3

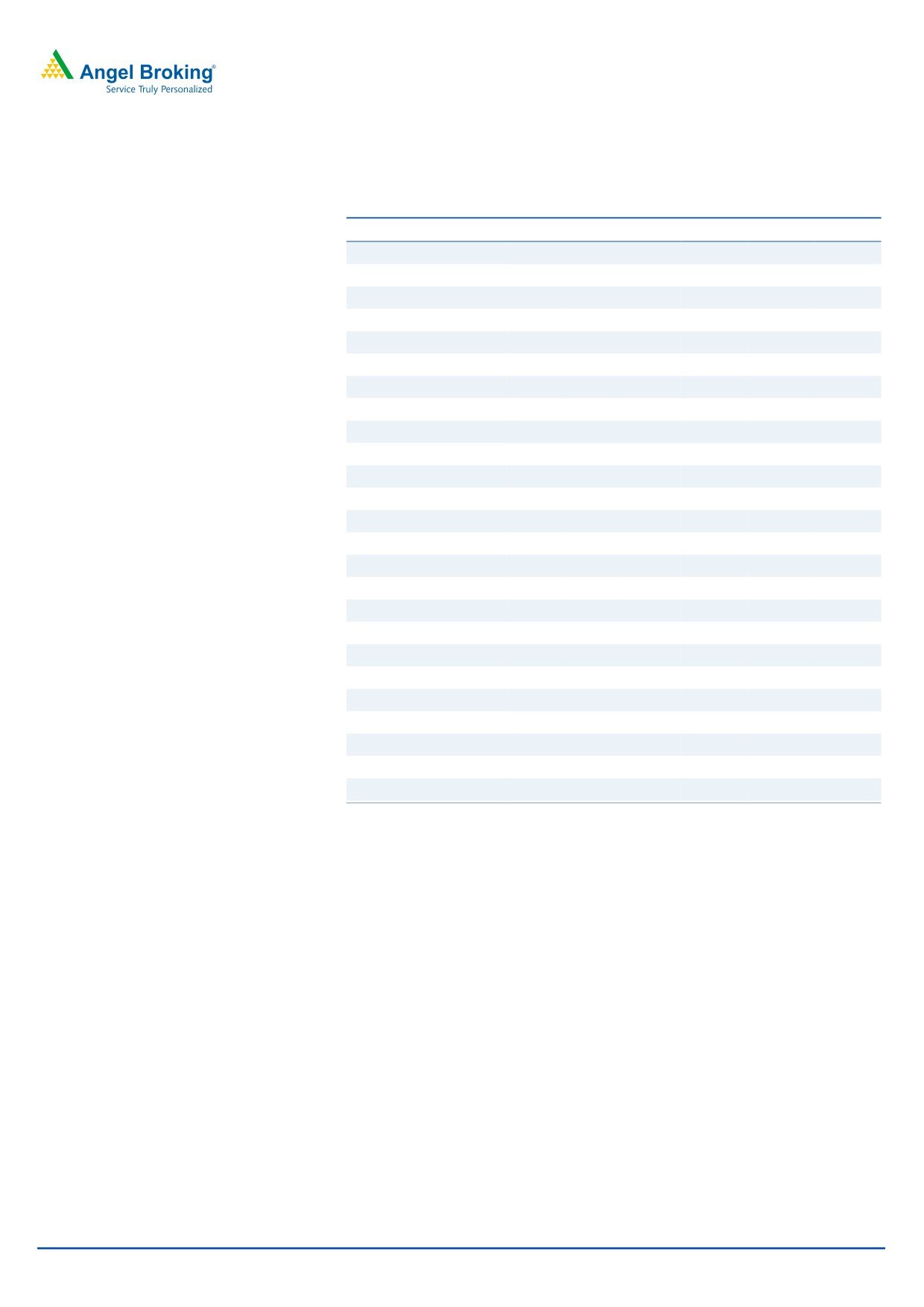

Yes Bank | Q1FY2019 Result Update

Income Statement

Y/E March (` cr)

FY15

FY16

FY17

FY18

FY19E FY20E

Net Interest Income

3,488

4,567

5,797

7,737

10,593

13,967

- YoY Growth (%)

28

31

27

33

37

32

Other Income

2,046

2,712

4,157

5,224

7,414

9,796

- YoY Growth (%)

19

33

53

26

42

32

Operating Income

5,534

7,279

9,954

12,961

18,007

23,763

- YoY Growth (%)

25

32

37

30

39

32

Operating Expenses

2,285

2,976

4,117

5,213

7,202

9,545

- YoY Growth (%)

31

30

38

27

38

33

Pre - Provision Profit

3,250

4,302

5,838

7,748

10,805

14,218

- YoY Growth (%)

21

32

36

33

39

32

Prov. & Cont.

339

536

793

1,554

1,923

2,500

- YoY Growth (%)

(6)

58

48

96

24

30

Profit Before Tax

2,910

3,766

5,044

6,194

8,882

11,718

- YoY Growth (%)

25

29

34

23

43

32

Prov. for Taxation

905

1,227

1,714

1,970

2,931

3,867

- as a % of PBT

31

33

34

32

33

33

PAT

2,005

2,539

3,330

4,225

5,951

7,851

- YoY Growth (%)

24

27

31

27

41

32

Balance Sheet

Y/E March (` cr)

FY15

FY16

FY17

FY18

FY19E FY20E

Equity

418

421

456

461

461

461

Reserve & Surplus

11,262

13,366

21,598

25,298

30,177

36,615

Net worth

11,680

13,787

22,054

25,758

30,638

37,076

Deposits

91,176

1,11,720

1,42,874

2,00,738

2,66,370

3,53,319

- Growth (%)

23

23

28

41

33

33

Borrowings

26,220

31,659

38,607

74,894

1,00,357

1,29,461

Other Liab. & Prov.

7,094

8,098

11,525

11,056

18,797

21,198

Total Liabilities

1,36,170

1,65,263

2,15,060

3,12,446

4,16,163

5,41,053

Cash Balances

5,241

5,776

6,952

11,426

15,181

20,140

Bank Balances

2,317

2,442

12,597

13,309

17,517

23,238

Investments

43,228

48,838

50,032

68,399

91,086

1,20,839

Advances

75,550

98,210

1,32,263

2,03,534

2,74,771

3,57,202

- Growth (%)

36

30

35

54

35

30

Fixed Assets

319

471

684

832

1,168

1,549

Other Assets

9,516

9,526

12,532

14,946

16,441

18,085

Total Assets

1,36,170

1,65,263

2,15,060

3,12,446

4,16,163

5,41,053

- Growth (%)

25

21

30

45

33

30

July 27, 2018

4

Yes Bank | Q1FY2019 Result Update

Key Ratio

Y/E March (` cr)

FY15

FY16

FY17

FY18

FY19

FY20

Profitability ratios (%)

NIMs

3.1

3.3

3.4

3.3

3.2

3.2

Cost to Income Ratio

41.3

40.9

41.4

40.2

40.0

40.2

RoA

1.6

1.7

1.8

1.6

1.6

1.6

RoE

21.3

19.9

18.6

17.7

21.1

23.2

B/S ratios (%)

CASA Ratio

0.23

0.28

0.36

0.36

0.38

0.39

Credit/Deposit Ratio

0.8

0.9

0.9

1.0

1.0

1.0

Asset Quality (%)

Gross NPAs

0.41

0.76

1.52

1.28

1.25

1.25

Gross NPAs (Amt)

313

749

2,018

2,626

3,434

4,465

Net NPAs

0.12

0.29

0.81

0.64

0.55

0.50

Net NPAs (Amt)

87

284

1,072

1,312

1,511

1,786

Credit Cost on Advance

0.45

0.55

0.60

0.76

0.70

0.70

Provision Coverage

72%

62%

47%

50%

56%

60%

Per Share Data (`)

EPS

8.7

11.0

14.5

18.3

25.8

34.1

BV

50.7

59.9

95.8

111.8

133.0

161.0

ABVPS (75% cover.)

50.7

59.4

93.3

109.0

130.2

158.1

DPS

1.8

2.0

2.4

2.7

4.7

6.1

Valuation Ratios

PER (x)

42.5

33.6

25.6

20.2

14.3

10.9

P/BV

7.3

6.2

3.9

3.3

2.8

2.3

P/ABVPS (x)

7.3

6.2

4.0

3.4

2.8

2.34

Dividend Yield

0.5

0.5

0.6

0.7

1.3

1.7

Note - Valuation done on closing price of 27/07/2018

July 27, 2018

5

Yes Bank | Q1FY2019 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Yes Bank

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

July 27, 2018

6